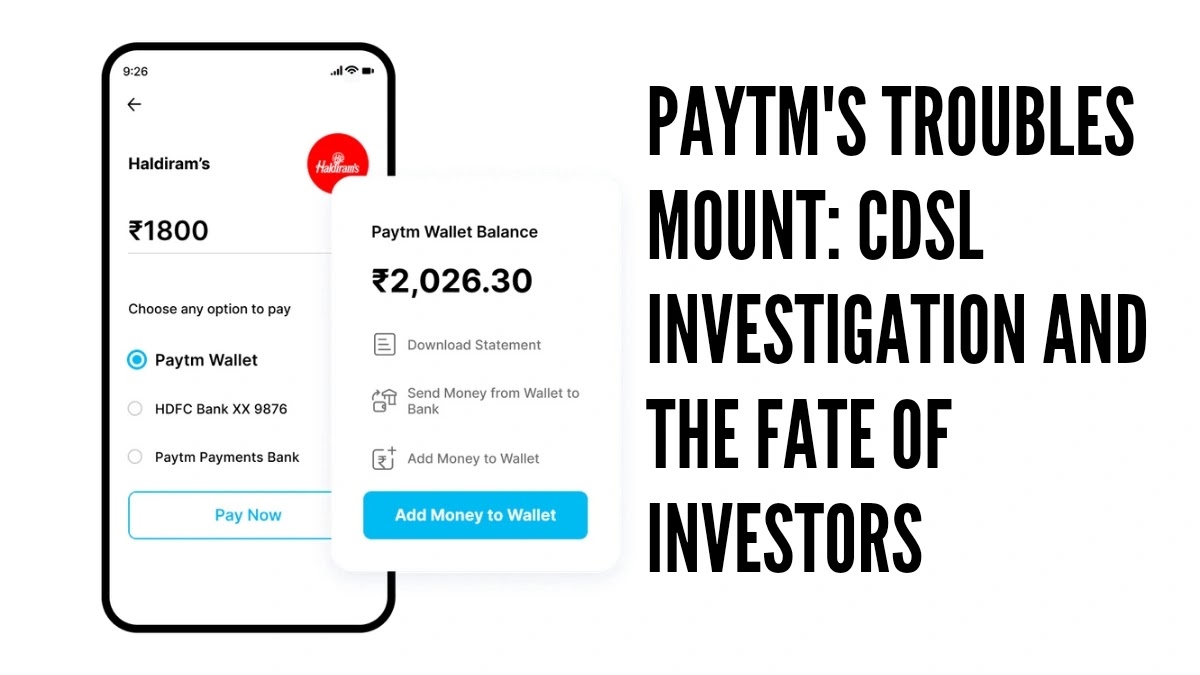

Paytm's Troubles Mount: CDSL Investigation and the Fate of Investors

The problems arising with Paytm do not seem to be ending. On January 31, the Reserve Bank imposed strict restrictions on Paytm Payments Bank. Due to this, Paytm shares fell by 42 percent in just three days.

Paytm founder and CEO Vijay Shekhar Sharma was rushing to deal with this crisis. Then, another bad news came for Paytm. What is the news and which business of Paytm can be affected this time, we will tell you in this blog post.

In fact, after RBI's action on Paytm Payments Bank, now the country's largest securities depository has taken action against Paytm. Central Depository Services India (CDSL) has started an in-depth investigation of the customer verification process of Paytm Money.

Paytm Money provides services for buying, selling shares, and opening demat accounts. It also offers mutual funds and NPS investments. It has more than 2 crore customers. In such a situation, the question arises:

What will happen to these investors due to CDSL's action on Paytm Money?

One 97 Communications is the parent company of all the businesses of Paytm. A media report said that CDSL action has started on Paytm Money. Many questions are being raised on the Know Your Customer (KYC) process of all the units of One 97. CDSL is the new authority in this matter and has tightened the noose on Paytm.

Earlier, the Reserve Bank had taken action against Paytm Payments Bank. RBI talked about banning all businesses of Paytm. RBI made it clear in its order that Paytm Payments Bank will have to stop all its banking services from February 29. After this order, Paytm is now stuck in a big problem and Vijay Shekhar Sharma had to control this crisis.

Sharma first met the officials of the Reserve Bank. He tried to understand the order of the Reserve Bank, what is happening in Paytm, and when it will be closed. After this Sharma met Finance Minister Nirmala Sitharaman.

However, in the meeting that lasted only 10 minutes, Sharma was told that the government had no role in Paytm's crisis. Paytm will have to follow the instructions of the RBI.

However, the Reserve Bank's order had no impact on Paytm Money. This company operates independently. CDSL and the National Security Depository (NSDL) conduct regular audits of these platforms. This audit checks if these platforms comply with regulations for anti-money laundering and KYC.

Paytm Money provides CDSL demat accounts to its users. Trading of shares and mutual funds is a highly regulated business. CDSL conducts audits and regular reviews under the regulations of SEBI, India's capital markets regulator.

Customer verification is a very important factor in the wealth management business. The depository holds investors' shares in demat form. It continuously examines the systems and processes of stock brokers. With this, any flaw can be detected in time.

.webp)